A fixer-upper’s guide to find money for residential energy efficiency upgrades.

For first-time homebuyers who are willing to put in a little sweat equity, and make their new homes more energy efficient in the process, here are a few financial resources to help fund renovations:

- Tax Credits

- Rebates

- Grants

- Loans

Tax Credits

Beginning in 2017, only solar panels and solar water heating projects will benefit from an IRS tax break. But, homeowners may receive up to 30% of costs associated with installing one of these solar energy systems, in the form of a federal tax credit. This credit is scheduled to expire on December 31st, 2021.

Viva Green Homes provides a year-by-year update on energy efficiency federal tax breaks. Before you submit your 2016 tax return, visit the VGH report, to make sure that you didn’t over-look a potential tax credit.

Rebates

ENERGY STAR claims that households could save about $8,200 and 72,000 pounds of CO2 over the lifespan of the products it certifies.

ENERGY STAR products may no longer be eligible for tax credits starting in 2017, but there are still rebates available such as furnaces and thermostats. And the energy efficient certification program offers a handy database of rebates that may be available in your area: https://www.energystar.gov/rebate-finder

Grants

Federal and State agencies offer money—for free! State-level grant programs for residential, agricultural, and commercial energy efficiency projects can be found in this remarkably easy to use database: http://www.dsireusa.org.

The two federal energy efficiency grants to look into are the WAP and REAP programs.

WAP GRANTS UP TO $6500

The Department of Energy’s Weatherization Assistance Program (WAP) offers a weatherization grant that includes a computerized assessment of your home’s energy use by a professional, non-profit, energy auditor. The auditor makes recommendations of the most cost-effective energy conservations measures that would benefit your home. If you approve the recommendations, a work crew is provided to install these upgrades and WAP covers the costs up to $6,500. The grant does not include new roofing, siding, or similar structural improvements.

Participants must apply with their state’s program administrator and there are restrictions for eligibility; one of the primary ones is income. To see if your state is participating and to apply, visit: http://www.waptac.org/grantee-contacts.aspx

REAP GRANTS FROM $2,500 - $250,000

The Department of Agriculture’s Rural Energy for America Program (REAP) is aimed towards agricultural producers (at least 50% of income from agriculture) and small rural businesses. States participating in REAP offer:

Renewable Energy System Grants

- $2,500 minimum

- $500,000 maximum

Energy Efficiency Grants:

- $1,500 minimum

- $250,000 maximum

The application deadline for this grant program is March 31st, 2017.

Loans

The Office of Energy Efficiency & Renewable Energy offers PowerSaver loans for homeowners to make home energy efficiency and renewable energy upgrades or improvements.

To see which loans and qualified lenders are available in your state, check out the agency’s map here: https://energy.gov/eere/buildings/maps/powersaver-loans.

POWERSAVER—ENERGY UPGRADE LOAN UP TO $7,500

This type of loan is for smaller projects such as insulation, air and duct sealing, water heating, and upgrading or replacing heating and cooling equipment. This is an unsecured consumer loan—no home appraisal is required.

POWERSAVER—FIRST MORTGAGE UP TO FHA LOAN LIMITS

This loan is for a home purchase or refinance. It can be used for energy efficiency improvements as part of an FHA 203(k) rehabilitation first mortgage when purchasing a home or refinancing an existing mortgage. For loan limits visit, https://entp.hud.gov/idapp/html/hicostlook.cfm.

POWERSAVER—HOME ENERGY RETROFIT LOAN UP TO $25,000

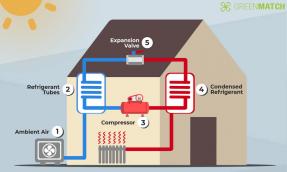

This is a second mortgage for primary residences made available by the DOE to help fund: solar PV, solar hot water, geothermal, or other energy efficiency projects.

For more information about the PowerSaver’s Home Energy Retrofit Loan criteria, visit: https://www.benefits.gov/benefits/benefit-details/5877.

Private Loans

PACE LOANS $5,000 - $100,000

PACE, or Property Assessed Clean Energy, is an innovative loan consisting of long-term private financing, that has recently received some controversial attention in an article from the Huffington Post.

While these funds are relatively easy to obtain, homeowners should make sure they understand the terms of the loan before committing. Homeowners are advised that the amount of the loan is added to their property tax assessment value. When weighing the total costs of this loan, homeowners should be aware that in addition to the loan’s interest rate, they will most likely be paying more in property taxes as well.

To see if a PACE program is available in your state, visit: http://pacenation.us/pace-programs/.

By Lyra DeLora Content Contributor for VivaGreenHomes.com

- Filed Under: Green Building Finance

- Keywords : Energy Efficiency, Green Building Finance, PACE Loans, EnergyStar

- ( 13819 ) views

Realty Sage is a residential real estate platform focusing on the value of energy efficient, renewable energy and smart technology in homes with a Sage Score. It hosts listings across the country, provides resources and connects you to eco-knowledgeable agents across the country! Agents, add your eco home listings and create your profile for free!

- ( 0 ) Ratings

- ( 0 ) Discussions

- ( 0 ) Group Posts

Reply/Leave a Comment (You must be logged in to leave a comment)

Connect with us!

Subscribe to our monthly newsletter:

Related Posts

-

-

How Can Hospitals Reduce Carbon Footprint? Nov 21, 2022

How Can Hospitals Reduce Carbon Footprint? Nov 21, 2022 -

-

Investing in Green Energy Improvements Jun 27, 2022

Investing in Green Energy Improvements Jun 27, 2022 -

Not a Member Yet? Register and Join the Community | Log in